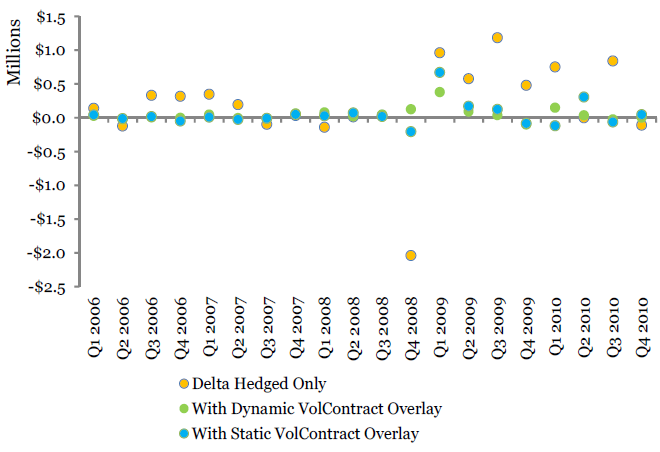

Portfolio Net Quarterly Profit

for Past Five Years

Remarks

The value of a RealVol futures

overlay during an extremely volatile

market period, such as the one studied,

should be expected. But how will the

strategy fare during other, less chaotic,

periods? The chart displayed here

considers a full five years of data, broken

down into 20 consecutive quarters, during

which three-month a RealVol futures (3VOL)

overlay was employed, again, both

dynamically and statically. The results are

impressive.

The net quarterly

profits of the total portfolios are displayed.

Note the considerable dispersion of results

around zero for the delta-hedged-only

options book, compared to the extremely

stable results obtained via the RealVol

futures overlays. Options market-makers should take great solace

in a methodology that could so effectively smooth out the

P&L swings of their books.

|

|

|

©

Copyright 2010-2021 RealVol LLC. All rights reserved

• Site Map

|

|